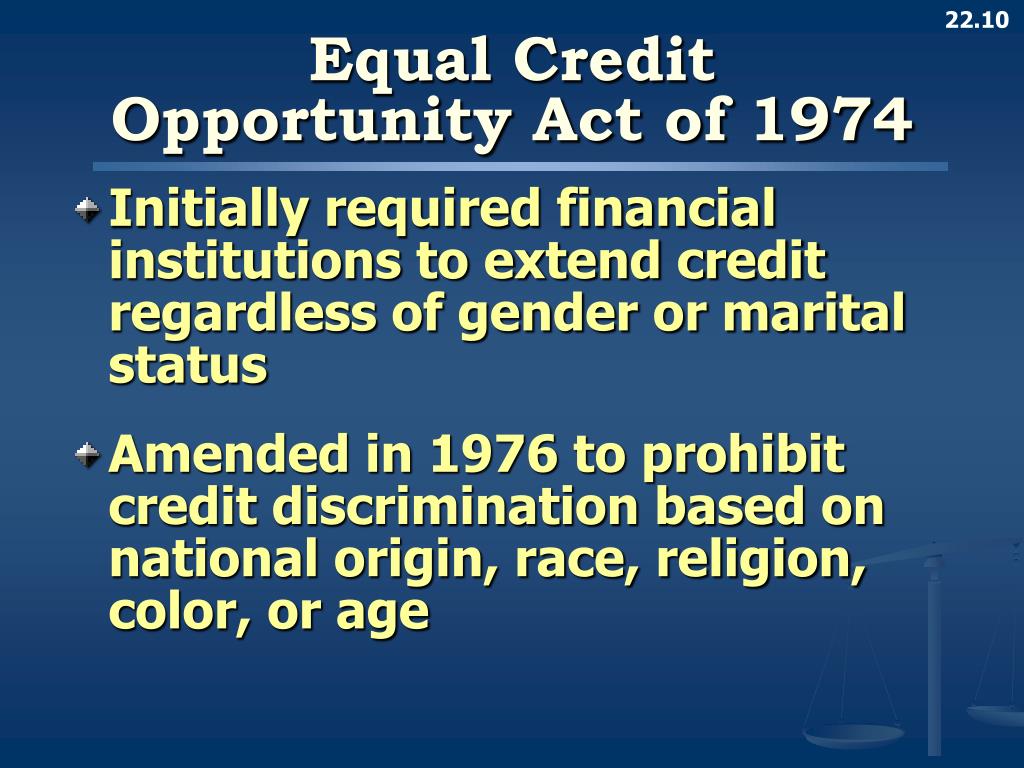

The regulation prohibits creditor practices that discriminate on the basis of any of these factors. The purpose of this part is to promote the availability of credit to all creditworthy applicants without regard to race, color, religion, national origin, sex, marital status, or age (provided the applicant has the capacity to contract) to the fact that all or part of the applicant's income derives from a public assistance program or to the fact that the applicant has in good faith exercised any right under the Consumer Credit Protection Act. Regulation B outlines the rules that lenders must adhere to when. See interpretation of 1(a) Authority and scope. Regulation B is a regulation intended to prevent applicants from being discriminated against in any aspect of a credit transaction. The term Bureau, as used in this part, means the Bureau of Consumer Financial Protection. Learn about the types of things creditors are prohibited from doing and more. The regulation does apply to lending activities that take place within the United States (as well as the Commonwealth of Puerto Rico and any territory or possession of the United States), whether or not the applicant is a citizen.ģ. Equal Credit Opportunity for Consumers The Equal Credit Opportunity Act (ECOA) ensures that all consumers are given a fair chance to obtain credit. Regulation B generally does not apply to lending activities that occur outside the United States. Moreover, the Act and regulation apply to all methods of credit evaluation, whether performed judgmentally or by use of a credit scoring system.Ģ. UNDER THE EQUAL CREDIT OPPORTUNITY ACT, IT IS ILLEGAL TO DISCRIMINATE IN ANY CREDIT TRANSACTION: On the basis of race, color, national origin, religion. 2 Comment, Credit Equality Comes to Women: An Analysis of the Equal Credit Opportunity. Further, the definition of creditor is not restricted to the party or person to whom the obligation is initially payable, as is the case under Regulation Z. The definition under 1002.2 (p) (1) (i) through (iv) sets the criteria that a credit system must meet in order to use age as a predictive factor. If a transaction provides for the deferral of the payment of a debt, it is credit covered by Regulation B even though it may not be a credit transaction covered by Regulation Z (Truth in Lending) (12 CFR part 1026). Official interpretation of 2 (p) Empirically derived and other credit scoring systems. The Equal Credit Opportunity Act and Regulation B apply to all credit - commercial as well as personal - without regard to the nature or type of the credit or the creditor, except for an entity excluded from coverage of this part (but not the Act) by section 1029 of the Consumer Financial Protection Act of 2010 (12 U.S.C.

0 kommentar(er)

0 kommentar(er)